Luis Sánchez Saturno / The New Mexican

Democratic Rep. Debbie Rodella of Española, chairwoman of the House Business and Industry Committee, listens to a lobbyist speak in support of House Bill 347 during the committee’s meeting Friday. The committee unanimously advanced the measure, which would limit interest rates on most small loans to 175 percent, though its prospects in the Senate could be dim, with only three weeks left in the session and pressing budget matters still ahead.

In a Roundhouse meeting room packed with lobbyists and a few consumer protection advocates, the House Business and Industry Committee on Friday quietly tabled a bill that would have capped the annual percentage rates for payday loans and other small loans at 36 percent. The 11-member panel didn’t vote on the matter. The committee’s chairwoman, Debbie Rodella, D-Española, simply asked her members if anyone objected. No one did.

It was an unceremonious end to a proposal that consumer protection advocates have pushed for years, trying to rein in an industry they say preys on the poor with annual percentage rates that can climb as high as 9,000 percent. And no one, not even the bill’s sponsor, who was not present, seemed surprised. And they shouldn’t have been.

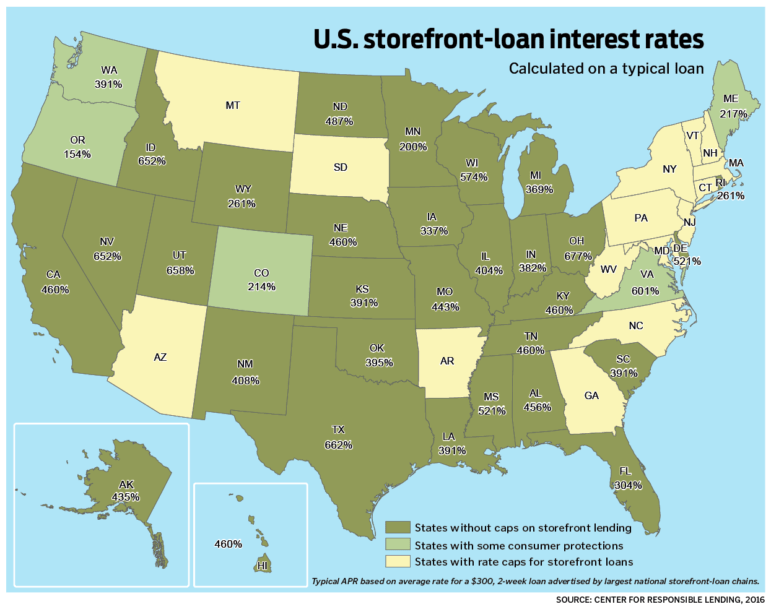

Since 2010, at least 11 bills that would have capped interest rates on storefront lenders have met quiet deaths without ever making it out of their initial committees. They were among 32 bills related to regulating the storefront lending industry that were killed in that period. While 15 other states, including Arizona, New York and Pennsylvania, have imposed such caps or banned payday lending altogether, lawmakers in New Mexico, which has among the most permissive small-loan lending laws, have been staunchly resistant.

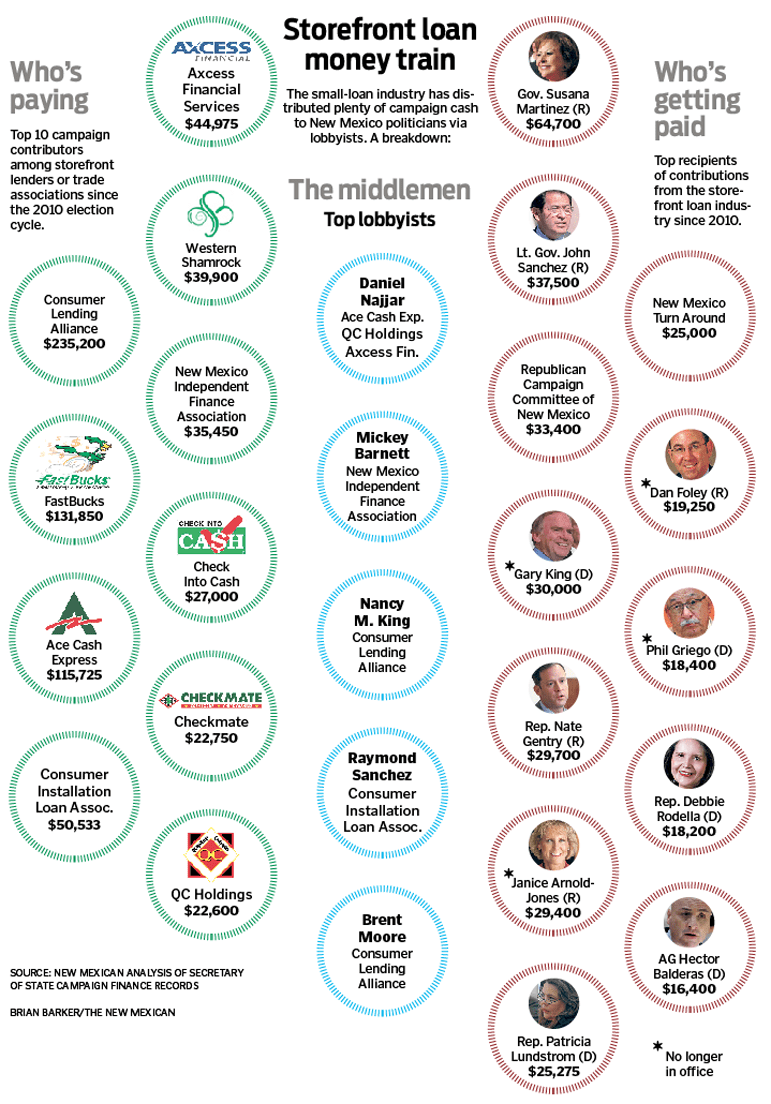

The storefront lending industry has rewarded them in kind, pumping more than $866,000 into campaign coffers since 2010. And while most of that money has gone to Republicans, the killing of payday lending bills has been a decidedly bipartisan enterprise, according to a New Mexican analysis of committee votes and campaign finance records over that period.

House Bill 26 was at least the third such bill to die in Rodella’s committee in the last seven years, a period in which she received $18,200 in donations from payday lending companies and industry lobby groups. A more frequent graveyard for small-loan bills was the Senate Corporations and Transportation Committee, chaired by former Democratic Sen. Phil Griego, D-San Jose. At least nine bills died there between 2010 and 2015, a period in which he received $18,400 before he abruptly resigned in 2015 amid an ethics scandal.

This inaction is a shame, said Steve Fischmann, a former state senator from Las Cruces (2009-12) who is co-chairman of the New Mexico Fair Lending Coalition, a group that has fought for interest rate limits.

“There’s so many things we do that are designed to loot poor people,” he said. “For me, [getting rid of the high interest rates] is an opportunity to change policy to stop looting the poor.”

Rodella’s committee on Friday unanimously advanced another bill, House Bill 347, that would limit interest rates on most small loans to 175 percent, though its prospects in the Senate could be dim, with only three weeks left in the session and pressing budget matters still ahead.

Rep. Patricia Roybal Caballero, D-Albuquerque, who sponsored HB 26, wasn’t even present when her bill was tabled. She was presenting an unrelated bill in another committee. But she wasn’t shocked at what happened. Having heard the committee discuss her bill as well as HB 347 earlier in the week, she said Friday that it was obvious she didn’t have the votes to get her legislation out of the committee.

A lack of movement

Since 2010, only three bills related to the industry have passed in the New Mexico Legislature. One was a nonbinding memorial, and the other two had virtually no impact on limiting the snowballing debt many of the people who turn to these loans, often in desperation, find themselves facing.

One of those bills exempted lenders charging an annual percentage rate below 175 percent from having to file yearly reports to the state Regulation and Licensing Department.

The last truly significant legislation to pass the Legislature and be signed by a governor was in 2007, when then Gov. Bill Richardson signed into law a measure that capped fees on loans to $15.50 per $100, restricted total loans by a consumer and prohibited immediate loan rollovers, in which a consumer could take out a new loan to pay off a previous loan. But, as those from both sides testified during a committee meeting last week, that bill was riddled with loopholes.

One company that found a way around those restrictions was FastBucks Holding Corp., a Dallas-based lender with a half-dozen stores around New Mexico at the time. FastBucks began offering new installment loans with effective annual percentage rates of 520 percent to 650 percent, according to testimony in a lawsuit brought in 2009 by then-state Attorney General Gary King.

Then-state District Judge Michael Vigil, in a 2012 ruling on the case, found the company designed the new loans to circumvent the 2007 regulations. “They dramatically increased their use of installment loan products and decreased the use of payday loans,” Vigil wrote in the decision.

FastBucks “took advantage of borrowers’ lack of knowledge, ability, experience or capacity to a grossly unfair degree by deliberately steering borrowers into loans that subjected them to higher interest rates that kept them locked into recurring cycles of debt,” Vigil wrote.

One customer, the judge noted, incurred $4,680 in debt for a $934 installment loan.

Another state judge last year ordered FastBucks to pay $32 million to New Mexico consumers in restitution resulting from the 2012 decision.

Industry largess

Despite the lawsuit, King was among the biggest recipients of industry donations over that period, receiving $30,000 for his 2010 re-election campaign, though none of that was from FastBucks.

FastBucks has given at least $131,850 to New Mexico candidates since 2010, according to The New Mexican’s analysis of campaign finance records, including $24,050 in the 2016 election. Only the Consumer Lending Alliance, a Florida-based industry group, has given more, with $235,200 in donations since 2010.

Other big-spending, small-loan contributors include Ace Cash Express, which has contributed $115,725 since 2010; the Consumer Installation Loan Association ($50,533); Axcess Financial Services ($44,975); Western Shamrock, an oil company also licensed to make small loans ($39,900); the New Mexico Independent Finance Association ($35,450); Check Into Cash ($27,000); Checkmate ($22,750); and QC Holdings ($22,600).

The politician who by far received the most from the industry is Gov. Susana Martinez, who has taken in $64,700 since 2010. About a third of that came from the Texas-based Ace Cash Express in 2012.

Next was Lt. Gov. John Sanchez, who has received $37,500, while the Republican Campaign Committee of New Mexico got $33,400.

Other major recipients of small-loan industry contributions include House Minority Leader Nate Gentry ($29,700); former Rep. Janice Arnold Jones, R-Albuquerque ($29,400); Rep. Patty Lundstrom, D-Gallup, who has carried industry-friendly legislation for years ($25,275); a conservative PAC, New Mexico Turn Around, which was active in 2010 ($25,000); and former House Minority Whip Dan Foley, R-Roswell ($19,250). They were followed in donations by Griego, Rodella and current Attorney General Hector Balderas, who has received $16,400.

Balderas has supported a 36 percent interest cap, though nobody from his staff appeared at the committee hearings last week.

Lundstrom and Rodella — along with Republicans Yvette Herrell of Alamogordo and Jane Powdrell-Culbert of Corrales — are co-sponsors of the industry-backed HB 347, which would, in effect, set maximum interest rates of 175 percent.

How did Lundstrom get involved in the issue?

“The city of Gallup has more small-loan lenders than any other community in the state of New Mexico, per capita,” she said in an interview last week. “And I don’t think that’s by coincidence. I think that’s because we’re a border community with the biggest Indian reservation in the country.”

Leaders of the Native American Voters Alliance have been some of the leading advocates this year in testifying against Lundstrom’s bill, saying high-interest loans have had a negative effect on Native communities.

Lundstrom, who sponsored the 2007 bill aimed at payday loans, consistently has opposed lower caps on interest rates. “Because these are businesses, they have to at least be able to make some profit,” she said. “You make it too low, they go out of business, and I think that leads people to start using internet lending or underground-type lending. … There’s no way we can regulate it, no way we can include any type of consumer protection. So, if the industry’s going to be here, I want it to be regulated,” she said, while still allowing businesses to profit.

A total of nine bills have been introduced this year that pertain to high-interest loans. HB 347 appears to have the best chance of passing, according to lawmakers and lobbyists following the bills. HB 26, with the 36 percent cap, was the first to die.

A companion bill in the Senate introduced by Sen. Bill Soules, D-Las Cruces, has yet to be heard. It also would cap interest rates at 36 percent.

While some lawmakers, including Rodella and Herrell, called the 175 percent cap in HB 347 a good compromise, consumer advocates say it’s still too high.

“I cannot and I will not support anything that’s in the triple digits,” Roybal Caballero said after Friday’s meeting.

According to a fiscal impact report accompanying the bills, a 2013 national survey by the Federal Deposit Insurance Corp. found that nearly 30 percent of New Mexico households reported using one or more “alternative financial services” such as nonbank money orders, nonbank check cashing, nonbank remittances, payday loans, pawn shop loans, rent-to-own loans and refund-anticipation loans.

Households that reported using one or more of these tended to be Hispanic, 25 to 34 years of age, employed, disabled and “unbanked.” Most users were not homeowners, lacked a high school degree and reported family income of less than $15,000 a year.

A report by the state Financial Institutions Division said interest rates for storefront loans vary wildly in New Mexico, and many are astronomical. Car title loans can go up to 456.3 percent, while unsecured installment loans can have interest rates of more than 900 percent. Secured installment loans can have interest rates amounting to nearly 5,000 percent, while “refund anticipation” loans sometimes soar to 9,000 percent.

Relationships and reluctance

Fischmann said money isn’t the only reason legislators have been reluctant to reform the industry. Relationships with lobbyists also play a role.

“A lot of it is relationships,” Fischmann said. “Relationships are so established, legislators tend to do what the lobbyists tell them to do, and they lose track of what the citizens want. It’s just human nature. [Lobbyists] are just people you see all the time.”

Nancy King, a lobbyist for the Consumer Lending Alliance, disputes that notion.

“It has not been a case of these high-powered lobbyists coming in and killing these bills,” King told The New Mexican. “They’ve failed because nobody has come up with a low-interest product for high-risk customers.”

“There is a need for these types of loans, the $300, $500, $600 loans,” she added. “People who can’t get bank loans and who don’t have credit cards need them for emergencies.”

She said she recently talked to a man who needed money to have his mother’s remains cremated and a woman who needed funds to travel to Arizona, where her son had been in a car wreck. The solution for both, King said, was a car title loan.

King said it’s easy for advocates to find terrible stories about those who have had bad experiences with storefront lenders — those who ended up paying thousands of dollars on loans that started out as a few hundred dollars because they kept borrowing more to pay the original loan.

“But there are thousands of examples of people who didn’t have these bad experiences, who were helped by having access to these small loans,” she said.

Advocates for lower rates tell a different story, saying the high loan rates are hurting consumers and keeping families in poverty.

“Out in the real world, when you even suggest a 36 percent rate cap to most people, they gasp in horror at how high that is,” said Lynn Canning of the Santa Fe Neighborhood Law Center. The 175 percent compromise, she said, falls far short.

“We still need to continue to move that cap down to a place that really will protect consumers and is not based on a business model that really hurts our families,” Canning said.

“Where is the political will of our Democrats?” Roybal Caballero asked. “Do we really want to get people out of poverty? Do we really want to rid them of vulnerability to exploitation?”

Or, she asked, “Do we want to continue to contribute to the coffers of the few at the sacrifice of the many?”

Contact Steve Terrell at (505) 986-3037 or sterrell@sfnewmexican.com. Read his political blog at santafenewmexican.com/