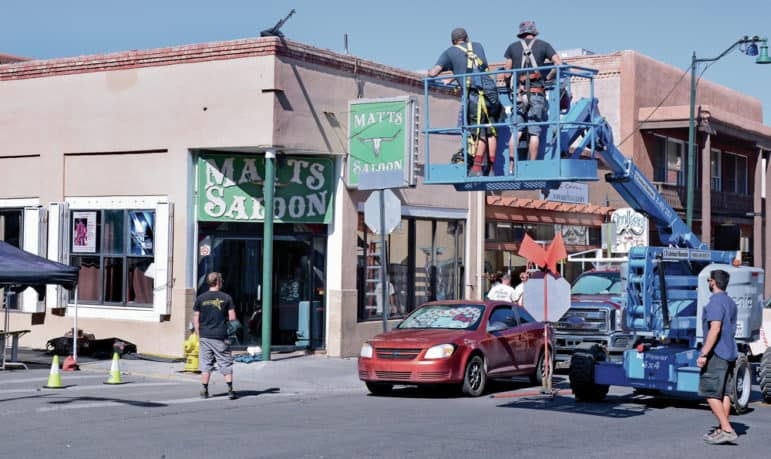

Clyde Mueller / The New Mexican

Evangelo’s bar at Galisteo and San Francisco streets is renamed ‘Matts Saloon’ as a film crew prepares to shoot a scene for Granite Mountain last summer.

A pair of state legislators wants to devote more money to rebates for moviemakers and television producers who do business in New Mexico.

Reps. Daymon Ely, D-Corrales, and Bill McCamley, D-Las Cruces, have introduced a bill that would increase the annual $50 million cap on New Mexico’s incentive program for film and television productions in the next fiscal year to account for inflation. In subsequent years, annual payouts would be tied to the consumer price index, which could further increase the amount of credits available to moviemakers.

“At some point, we have to declare, ‘We want to be a diverse economy,’ ” Ely said. “This is the way we do that. We focus on our strengths and weaknesses. And film is certainly our strength.”

House Bill 192 would raise the maximum payouts to qualifying film and television productions to $53.7 million from $50 million for the fiscal year beginning July 1.

This adjusts for an inflationary decrease in value since the current cap was enacted July 2011, Ely said.

In all subsequent fiscal years, the maximum number of tax credits to be paid out would be determined by a formula tied to the consumer price index, a federal statistical measure of retail price changes.

Under the state’s incentive program, film and television operations may apply to receive a refund of 25 percent or 30 percent on qualified expenses in production that are purchased through New Mexico-based companies.

The indexing maneuver would allow flexibility in the state’s payouts from year to year, Ely said, and is not necessarily an increase. But each year’s maximum would not, under the bill’s provisions, be permitted to sink below the previous year’s.

“The idea is to create some stability within the industry,” Ely said. “We want them to know this is how much money they can count on — and if anything, it’s going to go in one direction, which is up.”

“The two things that have worked in this state over the past 10 years, objectively, are trade with Mexico at the border … and the film industry,” said McCamley, who chairs the House Labor and Economic Development Committee.

New Mexico’s $50 million annual cap has received the scorn of some in the state film industry, who say it restricts the potential of a growing business. Film and television productions spent a record $387 million in the state in fiscal year 2016, and the number of major productions, as defined by the state film office, has increased in each of the past three years.

But in light of the state’s broad budgetary woes, others argue the state can’t afford to focus on film.

Paul J. Gessing, president of the Rio Grande Foundation, a nonpartisan Albuquerque-based think tank, said New Mexico must prioritize. “We oppose film subsidies on principle as corporate welfare, but we find it hard to believe that we’d want to take more money out of the treasury when we are already in a deficit situation,” Gessing wrote in an email.

Jon Hendry, business agent of the state’s film technicians union, agreed, saying it would be inappropriate to ask for more money for movies given today’s finances.

So, he said, the bill avoids doing that. “We don’t want to say we’re special,” he said. “We just want to bring it back to where it was. … 50 [million] was fine six years ago. Why isn’t it fine right now?”

“You want to create jobs in New Mexico? Put 50 million more in the cap, and I’ll get you more jobs,” added Hendry, who has been a vocal critic of the incentive cap. “But the state of New Mexico is flat broke, so none of that matters.”

As of Dec. 31, the state Taxation and Revenue Department reported $11.1 million in film production tax credits had been refunded in the current fiscal year.

In a fiscal impact report analyzing the legislation, New Mexico Film Office Director Nick Maniatis wrote that HB 192 “would relieve cap space and allow for additional production to take place.”

No other state or jurisdiction has yet married its film incentive program to a market index, said Joe Chianese, an industry observer and executive at Burbank, Calif.-based Entertainment Partners. But a similar proposal to tie annual film incentive payouts to the consumer price index is under legislative consideration in New York, where the annual cap on tax credits for film productions is $420 million.

Contact Tripp Stelnicki at (505) 428-7626 or tstelnicki@sfnewmexican.com.