ProPublica’s reporting on the water crisis in the American West has highlighted any number of confounding contradictions worsening the problem: Farmers are encouraged to waste water so as to protect their legal rights to its dwindling supply in the years ahead; Las Vegas sought to impose restrictions on water use while placing no checks on its explosive population growth; the federal government has encouraged farmers to improve efficiency in watering crops, but continues to subsidize the growing of thirsty crops such as cotton in desert states like Arizona.

Today, we offer another installment in the contradictions amid a crisis.

In parts of the western U.S., wracked by historic drought, you can get a tax break for using an abundance of water.

That’s a typo, right? A joke?

Ah, no. But we understand your bafflement. The Colorado River has been trickling, its largest reservoirs less than half full. As recently as 2014 parts of Texas literally almost dried up. The National Academy of Sciences predicts the Southwest may be on the cusp of its worst dry spell in 1,000 years. Scientists are warning that the backup plan — groundwater aquifers from California to Nebraska — are all being sucked dry.

But, yes, the tax break exists — in parts of eight High Plains states.

Here’s how it works: Farmers — or anyone who uses water in a business — can ask the Internal Revenue Service for a tax write-off for what’s called a “depleted asset.” In certain places, water counts as an asset, just like oil, or minerals like copper. The more water gets used, the more cash credit farmers can claim against their income tax. And that’s just what almost 3,000 Texas landowners in just one water district appear to have done last year — a year in which nearly half of Texas was in a state of “severe” or “extreme” drought.”

Yikes. How much can they write off?

A bunch it seems, especially if you’re a big farm and own a lot of land. We talked to an accountant in Levelland, Texas. He had a client who wrote off $10,000. “Whenever you buy land, you’re getting the dirt … and of course you are getting the water,” said Sham Myatt, the accountant. And the idea is that that water is part of what you paid for in the land deal. If the aquifer was 50 feet deep at the time of the land sale, and it drops 10 feet in a dry year, then the farmer can deduct one-fifth of the value, and so on, until all the water is gone.

Courtesy photo

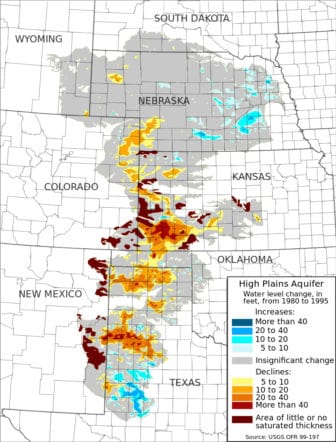

Regions in the Ogallala Aquifer where the water level declined between 1980 and 1995 are shown in yellow and red; regions where it increased are shown in shades of blue. The data for this map came from the USGS.

That’s not going to do much to conserve water, is it?

No. It’s not. In fact it’s an incentive to do the exact opposite. A farmer who tries to use less water because of the drought, say, by switching to really efficient irrigation techniques, could actually make less money. His water might last longer, but producing his crop would get a lot more expensive.

We called Nicholas Brozovic, an associate professor of agricultural economics and director of policy at the University of Nebraska’s Robert B. Daugherty Water for Food Institute. He’d actually never heard of the water deduction; it’s that obscure. But he laid out some textbook economics: If you’re overusing your water, then you are depreciating it, he said. And if the government pays for that, they are subsidizing that depreciation. “The more you deplete your groundwater, the higher your tax exemption and that must create an incentive not to conserve,” he said.

Hasn’t the federal government spent billions subsidizing conservation and the protection of the West’s groundwater, in part by building dams and encouraging people to use the water in rivers instead? Why would they forfeit federal tax dollars to do the opposite?

We called the IRS, and they initially shared our doubts. Not because they cared much about groundwater (it’s a tax agency!) but because they said they were pretty sure no such deduction was legal. They pointed us to section 613 of the tax code, and it couldn’t be more explicit: For the purposes of deducting the depreciating value of minerals, the definition “does not include soil, sod, dirt, turf, water, or mosses.” Ok, who would ever have thought of deducting mosses or sod? But anyway. That left us really confused.

Right, there were, after all, those farmers in Texas who seemed to have benefited from what the IRS said was not possible.

We encouraged the IRS to check again. They did. And then they found the provision they thought didn’t exist — right there in the text for Revenue Rule 65–296. An IRS spokesperson laid out for us the specifics: “Taxpayers are entitled to a cost depletion deduction for the exhaustion of their capital investment in the ground water extracted and disposed of by them in their business of irrigation farming specifically from the Ogallala Formation.”

Seems like some follow-up questions were in order.

For sure. We asked for clarification. The IRS said it would try to explain. Most importantly, they wanted to say it wasn’t quite as crazy as it sounded. The deduction is only available for one small part of the country — an area that includes parts of Texas, New Mexico, Oklahoma, Nebraska, Kansas, South Dakota, Wyoming and Colorado. And it should only apply if people are using water from a source that is running dry anyway.

But wait, what? You get a break when you use resources that are already in danger of vanishing?

Yes, that’s why it is what’s called a depleted asset. It’s of less and less value with every day. Your car is worth less the moment you drive it off the lot. Or, more similarly, oil companies track the falling value of their reserves the more they pump out from underground. In fact, energy companies have been taking oil depletion breaks for decades. Texas landowners would say their property is getting less valuable the less water there is to use on it.

Okay, okay, but water isn’t oil. It’s not a commodity. Access to it is a basic right. Yes? Please say that’s right.

Wrong. Ouch. I know, it hurts. But ProPublica last year wrote about all the ways water is coveted and controlled — and then often wasted — by just a few powerful groups. In most of the West, only some people and businesses have rights to it, depending on who showed up to claim it first. One big trend is that water is increasingly being bought and sold — including by hedge funds and big Wall Street investors, and the less water there is, the more the price is going up.

That’s a little scary. Let’s get back to depleted assets. So when did this tax break start?

About 50 years ago. A farmer in the Texas panhandle — along with his local water district — successfully sued the IRS, arguing that the roughly 200 million gallons he drew from his groundwater each year was no different than the depletion of the state’s other great natural resource, oil. He won, and the IRS was obliged to create rule 65–296 — the special allowance for tax credits that the IRS almost forgot about.

Again, it was supposed to be limited — just to a slice of Texas and eastern New Mexico. The court even went so far as to warn that the case shouldn’t become a precedent for groundwater tax claims elsewhere, saying the conditions in that area of the country were unique. But it didn’t take long for the rule to be expanded, albeit just a little bit. By the mid 1980s any landowner overlying the sprawling Ogallala aquifer — a giant underground vault of precious but dwindling water — was eligible to file for the deductions, not just in North Texas and New Mexico.

That still doesn’t sound like much of a big deal … why does it matter?

Well, the Ogallala, which spans from central Texas north to Nebraska and South Dakota is the nation’s largest groundwater reserve and is one of the most important, and (famously) threatened water supplies in the country. Its heavy overuse and plummeting water levels rang alarms among policymakers more than half a century ago. So this is no insignificant place to be even indirectly encouraging overuse. Texas’ High Plains are one of the most intensely irrigated and productive farming regions in the country. Hundreds of thousands of acres of cotton and corn, among other staple commodities, are grown there using this Ogallala water.

So, do we know what’s happening to the Ogallala where all this farming is taking place?

We looked at recent water level changes in just one district — the one with thousands of tax credit claims — and found a disturbing trend. Underground water levels in the 16 counties of the High Plains Underground Water Conservation District have dropped nearly 10 feet over the last 10 years. Some parts of Castro County saw water levels drop more than five feet over the course of 2015 alone. The federal government estimates nearly 100 cubic miles of water have been withdrawn from the Ogallala in that part of Texas. That doesn’t automatically mean the tax credits are responsible — water levels are dropping in most places thanks to overuse and it would take a lot more research to link up the cause and effect. But it certainly isn’t a portrait of sustainability.

Aquifers are at risk across Arizona, California and other states as well, right? At least people can’t claim tax breaks there?

Not yet. But that could change, as water supplies worsen and word of the tax break circulates more widely. Almost no one we spoke with had heard of it — not water lawyers in Arizona or groundwater conservation scientists in California. Armed with the knowledge, there’s a pretty good chance farmers and businesses across the West could seek tax relief.

Because there is precedent?

Exactly.

What does the IRS say to that?

They say it’s very unlikely, mostly because they think the conditions in the Ogallala are rare, and that the agency’s policy is to reject water allowance claims anywhere outside of the places covered in the original lawsuit. But if more landowners, in more places, were to file suits challenging the IRS to allow them to deduct for their water, or if they were to petition the IRS directly, the agency says it would undertake a review to consider it on a case by case basis. Landowners would have to present extensive scientific evidence that showed their situation was more or less the same as in North Texas.

Is the IRS equipped to make such judgments?

Fair question. John Leshy, professor emeritus at the University of California Hastings College of the Law, and a former solicitor for the U.S. Department of Interior, isn’t persuaded. “The IRS has really created a can of worms for itself,” he said. “It doesn’t have any hydrological expertise.”

Hmmm. Not ideal. But what’s the bottom line? Are these tax breaks going to make any real difference in how quickly we use up the water supply?

It’s hard to tell, partly because no one appears to have examined that question. We asked the IRS for data on the number of claims and it hasn’t responded. Folks in Texas dismiss the suggestion that the tax benefits are incentivizing water use as ludicrous. Myatt, the accountant, points out that only about one-third of the deducted value translates to cash in hand, and says for many smaller farmers that amounts to just a few hundred dollars. Jason Coleman, manager of the High Plains Underground Water Conservation District, says his members are as concerned about conserving their water for the future as anyone. “Its already a declining resource,” he said. “I just can’t imagine someone saying I’m going to depreciate our resource any more because of a tax claim.”

But the academic consensus is that incentives encourage use, even overuse. And if the effect of depletion allowances on oil production are any guide — Leshy says they have spurred overproduction and led to artificially cheap, subsidized fuel prices — any significant expansion of the groundwater tax credit to other states could have lasting impacts on the way groundwater is used across the country.

So is anyone trying to do anything about this?

Not really, which is why people like Brent Blackwelder, president emeritus of the environmental group Friends of the Earth, which has long been involved in rooting out tax policy disincentives to conservation, are fuming. “It’s a pretty major outrage that we would so stupidly reward the over extraction and non-sustainable use of groundwater,” he told me. Blackwelder helped push to purge the tax code of perverse anti-conservation incentives like this one way back in the Reagan administration, with the 1986 Tax Reform Act. They were largely successful, weeding out several other odd loopholes. But the groundwater depletion allowance persisted. And since then, apparently, it’s been forgotten about by all but the farmers who rely on it.